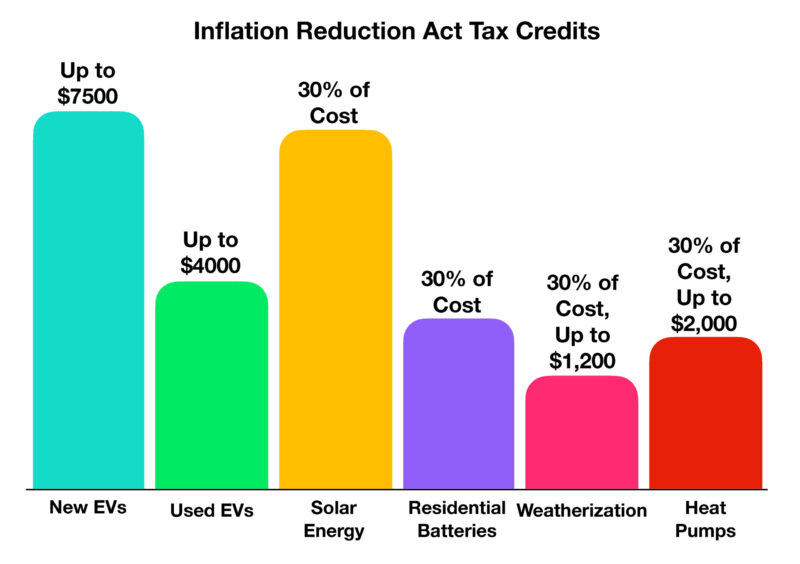

With Congress passing the Inflation Reduction Act (IRA) in 2022, consumers are expected to see new tax savings centered around environmentally-friendly energy. Throughout the ten-year plan, home renovations and upgrades are expected to generate savings for households.

The most significant of these credits is a 30% tax credit against federal income taxes for the cost of installing solar energy equipment. This credit has no limit, and 30% will apply regardless of the amount spent on installation. The credit will remain until the end of 2032, then decrease to 26% in 2033, 22% in 2034, and eventually phase out in 2035.

Heat pumps are also receiving sizable incentives through the act. Low-income households will receive a rebate of 100% for the cost of a heat pump, while moderate-income households will receive 50% of the heat pump expense. Homeowners can qualify for a 30% tax credit up to $2,000 for home energy efficiency projects, which covers heat pumps. For weatherization, homeowners can receive a tax credit of 30% for up to $1,200 per year. For households installing residential batteries, a tax credit of 30% is available for the equipment and installation cost.

Sources: U.S. Congress, Internal Revenue Service, U.S. Department of Energy

Print Version: IRA Act Credits April 2023