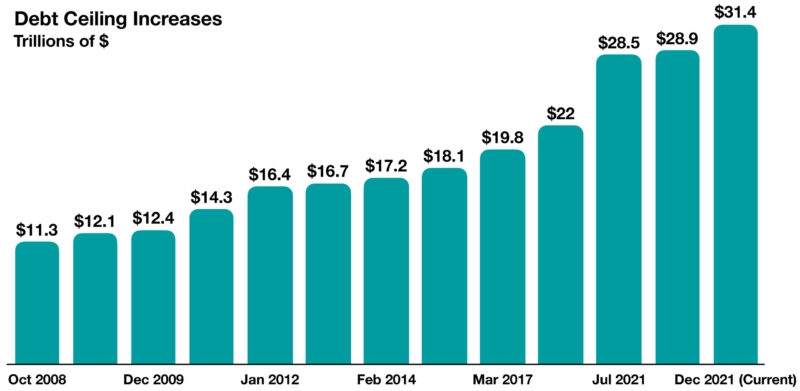

In the decades following World War II, the U.S. has seen its debt level steadily increase as the government has faced growing financial commitments. More recently, however, government debt has been expanding at a more significant pace since the early 2000s. Through these past two decades, there have been several political disputes regarding the debt ceiling, which is the limit of debt the government can issue. In January, the debt ceiling of $31.4 trillion was surpassed, which prompted the U.S. Treasury to implement “extraordinary measures” that will last until early summer to avoid the government defaulting on debt.

There have been several debt ceiling hurdles since the turn of the 20th century. Fortunately, the U.S. has never defaulted on its debt, which means the Treasury would be unable to pay its obligations. However, 2011 saw a point of near default, leading to credit rating agencies’ first downgrade of U.S. debt. In 2013, debates regarding the debt ceiling rose again, with the government experiencing a partial shutdown that led to the furloughing of hundreds of thousands of federal employees until the debt ceiling was suspended. More recently, another government shutdown occurred in 2018 when the debt ceiling yet again failed to be raised. Now, in 2023, the debt ceiling saw a near-default due to political gridlock and differing interests by the main political parties. The resolution to this will delay further debt negotiations until 2025, suspending the debt ceiling and keeping spending largely at its current level.

The risks of default include severe domestic and global economic repercussions, market volatility, and damage to confidence in the U.S. government’s ability to manage its finances. As political gridlock has driven another debt ceiling crisis, it is important to note that extremely similar circumstances have occurred in the past and will likely continue to occur.

Sources: Congressional Research Service, U.S. Department of the Treasury

Print Version: June 2023 Recent History of the Debt Ceiling Fiscal Policy