Credit scores are a vital piece in determining whether an individual is qualified for a plethora of life-changing purchases, from mortgages to auto loans. However, even consumers with a pristine history of on-time payments and proper debt management can see that their credit scores decline in retirement.

Data shows that credit scores tend to peak for consumers in their 70s, while tending to decline going into one’s 80s and beyond. Retirees of these ages typically enter retirement with long credit histories, but when they close decades-old accounts they can inadvertently cause swift declines to their credit scores. Additionally, at older ages, many individuals have already finished paying off mortgage loans, whereas credit scores reward individuals for paying current loan payments on time.

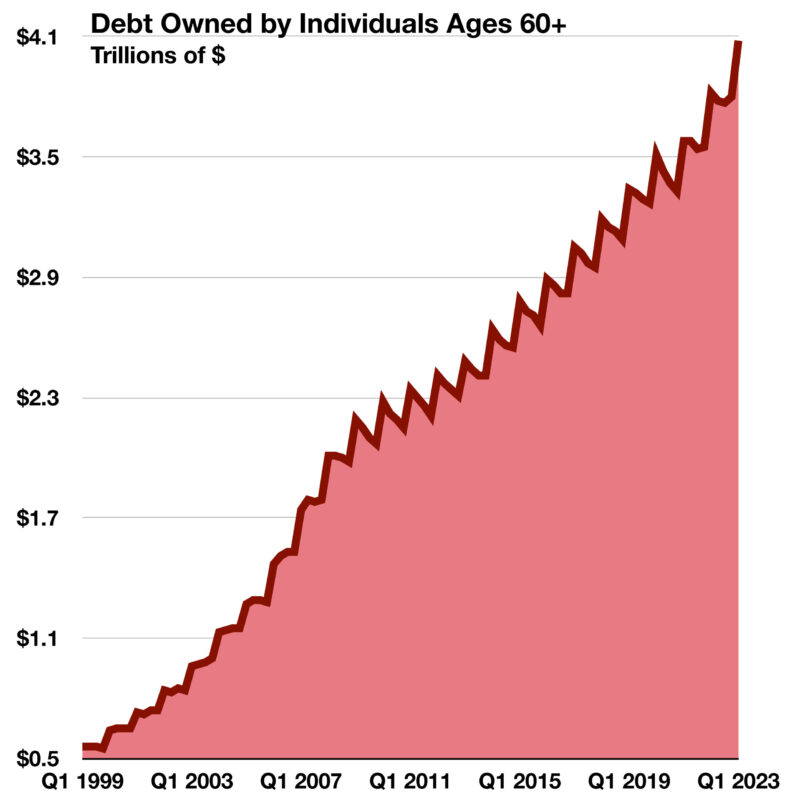

While a greater percentage of retirees have financial freedom and take out fewer loans, credit scores can be crucial in determining insurance premiums and in applications to assisted-living facilities. However, today’s seniors have accumulated debt faster than any other age group over the past 20 years, surpassing $4 trillion in senior debt in 2023.

Sources: New York Fed Consumer Credit Panel/Equifax

Print Version: August 2023 Credit Scores Tend to Drop After Retirement Planning