A survey released by the Federal Reserve Bank of Dallas found that overall credit and lending activity is deteriorating nationwide. The survey encompasses loan activity among larger banks, regional banks, finance companies, and various lenders.

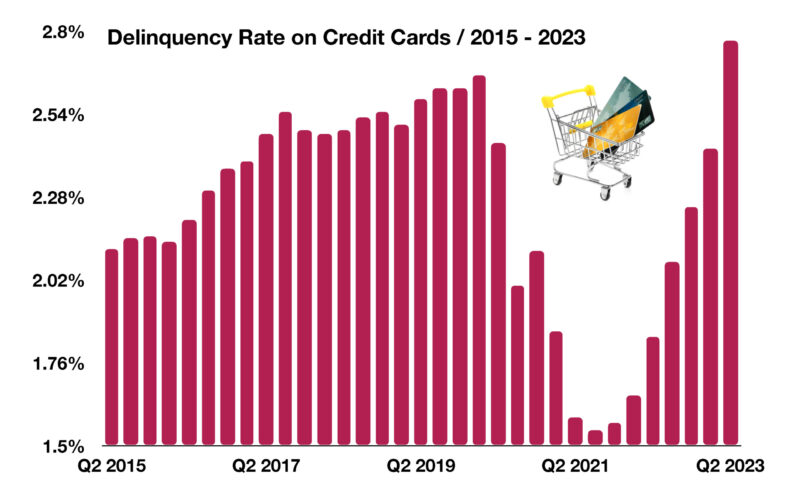

The primary concern of this report centers around rising delinquency rates on credit cards, which indicates ongoing trends pertaining to consumer behavior. Consumers have become more accustomed to taking on debt, which declined during the pandemic. However, consumers are now financing an increasingly high level of purchases, which has also driven up rates of delinquency.

This is of particular interest to economists, who view this dynamic as a worrying sign for consumer spending. In 2023, credit card delinquency rates reached their highest level in over a decade, surpassing levels last seen in late 2012. When consumers increasingly take on debt which they are unable to pay back, it creates a delinquency cycle that poses financial duress for consumers. Delinquency rates fell substantially in 2021 as pandemic assistance funds helped alleviate the debt burden of millions of credit card holders, yet catapulted back up once those funds were exhausted.

Sources: Board of Governors of the Federal Reserve System, Federal Reserve Bank of St. Louis, Federal Reserve Bank of Dallas.

Print Version: Delinquency Rates Sept 2023