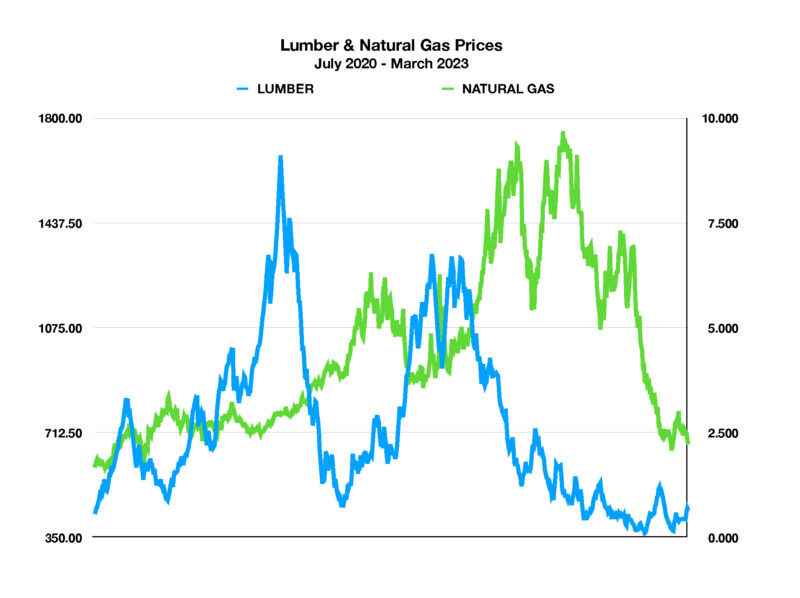

The past year has been one of turmoil for natural resources, especially due to global instability amidst the war in Ukraine and supply constraints. Two vital commodities affected, lumber and natural gas, have seen heightened price volatility. As of this past month, both commodities are off 70% from their highs which were reached in 2022. Economists view lumber and natural gas as leading indicators in their respective industries, signaling that dropping prices are expected to present a deflationary trend that may evolve over the coming months.

In spring 2021, lumber surpassed $1600 per thousand board feet, with this essential housing material serving as a catalyst for inflation throughout 2022. As depicted by lumber’s skyrocketing price, the housing market’s historic demand fell to close 2022 with housing prices continuously outpacing inflation. Now, lumber’s falling prices are expected to once again reflect the future state of the housing market. The market for lumber is now seeing demand for lumber fall, with its price falling accordingly. Since the primary use of lumber in the U.S. is for housing, a continuation of falling prices may indicate that demand in the housing market is going to continue to fall in the coming months.

Another resource exhibiting similar trends is natural gas, with increasing supplies along with falling demand. With European nations cutting off Russian gas as a result of the war in Ukraine, the export of natural gas rose significantly and raised prices for natural gas domestically. In the U.S., natural gas consumption fell throughout March, with diminishing demand for natural gas expected to continue to drive a return to normal prices, following similar trends as lumber.

Sources: U.S. Energy Information Administration, NASDAQ, S&P Global Commodity Insights

Print Version: Lumber Natural Gas Prices April 2023