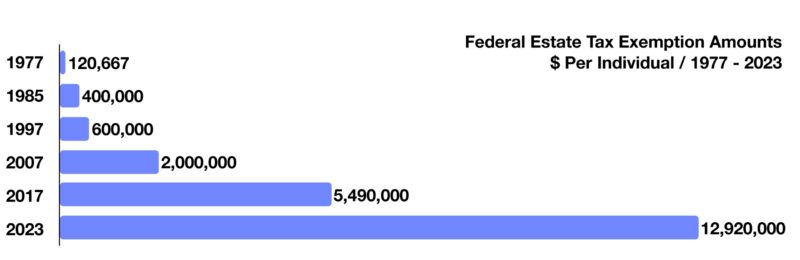

Estate tax exemptions began with the Revenue Act of 1916, which imposed a transfer of wealth tax on the estate of any deceased U.S. citizen valued above a certain amount at the time of death. In 1916, the exemption amount was $50,000, today that amount is $12.92 million. Over the decades, however, the exemption amount has varied, driven primarily by lawmakers and inflation indices. In 1977, the exemption amount was $120,667, then gradually increased over the years to $5.49 million in 2017. The current exemption is expected to revert to $5 million on January 1, 2026, yet may be higher depending on where inflation is at that time. Some estimate the revised exemption amount to reach between $6 to $7 million after adjusting for inflation.

Sources: IRS; https://www.irs.gov/businesses/small-businesses-self-employed/estate-tax

Print Version: Estate Tax Redemption Nov 2023