With interest rates breaching higher levels, mortgages are becoming less affordable for millions of Americans. As a result, demand for new mortgages continues to reach decades-long lows, influencing homebuyers to either wait for rates to fall or for home prices to drop significantly.

Economists believe that a unique dynamic has evolved from the current housing environment. Existing homeowners with low mortgage rates are hesitant to sell and move into a higher-rate mortgage, enticing homeowners to stay put. This in effect minimizes the inventory of homes available for sale and possibly acts as a price buffer for available homes.

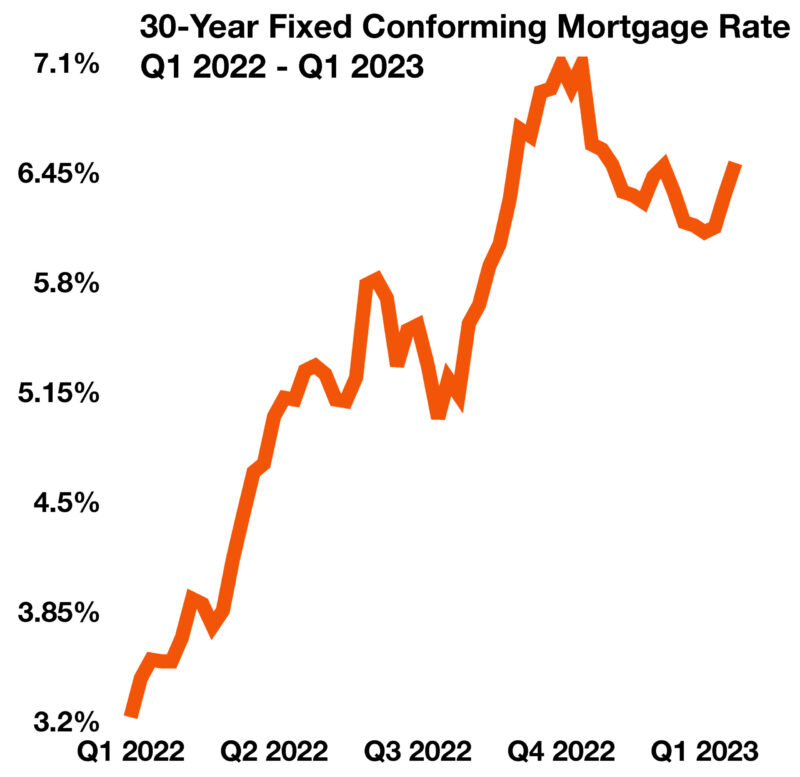

The 30-year fixed mortgage rate reached 6.65% in early March, its highest point since November of last year. This comes amidst continuously higher mortgage loan rates that reached as high as 7.08% in October and November of 2022, a 20-year high that the housing market last saw in 2002.

Sources: Federal Reserve of St. Louis, Freddie Mac.

Print Version: Higher Mortgage Rates Keep Homebuyers from Buying March 2023