In response to an aging American population, a bipartisan retirement measure passing through Congress looks to assist Americans nearing retirement in the next decade. The measure, titled Secure Act 2.0, builds upon previous changes to retirement policies in 2019 and makes saving for retirement easier.

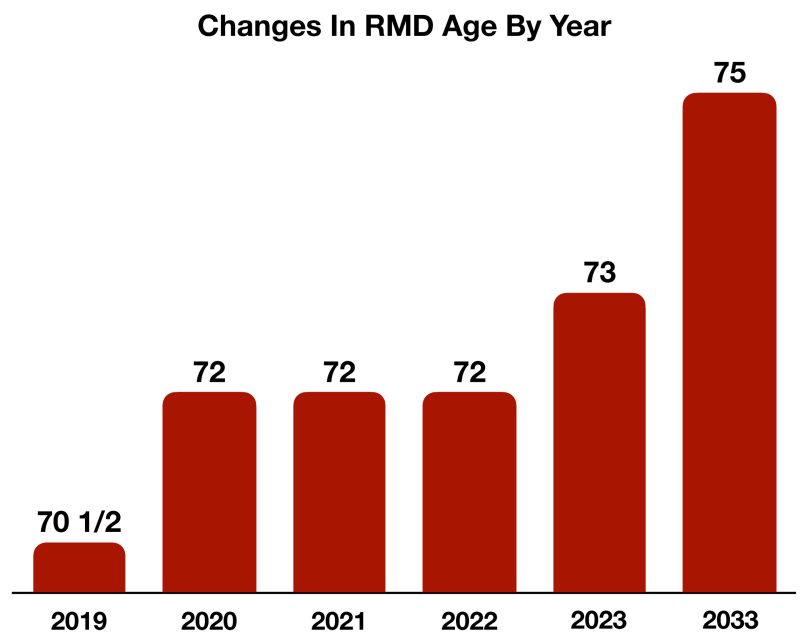

A major highlight of the Secure Act 2.0 is to increase the age at which required minimum distributions (RMDs) begin, allowing workers and retirees to leave funds in retirement accounts for longer, thus pushing off additional tax liability. In 2019, the RMD age was raised from 70½ years of age to 72. Now, the Secure Act 2.0 raises it to 73 beginning in 2023 and to 75 in 2033. These gradual changes are expected to accommodate and assist an incoming wave of baby boomers nearing retirement. With a few extra years before RMDs kick in, older workers have greater incentives to continue saving for retirement.

Company-sponsored retirement plans will require automatic enrollments into 401(k) and 403(b) plans, whereas it is currently only optional for employ ers to do so. In these plans, employers must also set up a contribution rate between 3% and 10%, plus an automatic contribution increase of 1% annually until a range of 10% to 15% is met. This provision will go into effect beginning December 31, 2024.

Another key change introduced by the Secure Act 2.0 will be allowing employer contributions for student loan payments. This would allow employers to match contributions to employee retirement plans based on student loan payments, easing the journey of saving for retirement. In the case of an emergency, Secure Act 2.0 also allows for a penalty-free withdrawal of up to $1,000 a year versus a previous 10% early-withdrawal penalty for withdrawals made under the age of 59½. Secure Act 2.0 also raises the ceilings on catch-up payments made past the age of 50, with an emphasis on payments made between the ages of 60 and 63.

In summary, the bill will allow for soon-to-be retirees to save more easily and for a longer period than before, reflecting a growing, older population and expanding retirement postponements.

Sources: U.S. Congress; Internal Revenue Service

Print Version: Highlights From The SECURE Act 2.0-Retirement Planning Jan 2023